Kiritsu and how Japanese gaming companies have succeeded in standing up to foreign investment

Kiritsu and how Japanese gaming companies have succeeded in standing up to foreign investment

Japan was known for being a closed country that did not welcome outsiders, and despite all the global systems that were established to popularize trade and cultural exchange, Japan was able to keep pace with modern systems while preserving its traditions, and its trade remained immune and impervious to the control of foreign investors compared to other countries. To this day, all video game companies have maintained their independence, so how did that happen? This brings us first to the ancient Japanese system of trade which was known as the Zaibatsu. This system simply refers to the vertical control and monopoly of a group of families over trade in Japan. This trade is the domain of that family and that trade is the domain of another family, and so on. Vertical control means the family's control over all stages of the business process from raw materials and manufacturing to production and sale. Of course, these families became very influential, very wealthy, and had a close relationship with the Japanese Empire itself.

This monopoly system was the beating heart of trade when Japan began to flourish in the Meiji era, but Japan's loss in World War II changed that, and the Allied forces imposed on Japan to abandon this system in 1945 with strict rules. Despite Japan's forced abandonment of the Zaibatsu system, the system was not completely dead, and it was more complicated than that. The coalition forces imposed through its command center (GHQ) the confiscation of the wealth, property, and shares of members of senior Japanese families with the aim of dismantling their large companies, and wanted to compensate them with inflexible bonds that they were not even entitled to borrow or dispose of, as General “Douglas MacArthur” ordered the freezing of the shares and The fortunes of the 10 richest Japanese families, but the Japanese committees that were tasked with implementing these instructions wanted to protect the Japanese economy and protect the families.

The confiscation of the property of the Zaibatsu in 1946 from the coalition forces

Employees of companies affiliated with the zaibatsu families obtained priority in the right to buy the shares of the families that were put up for sale, and an article from Dartmouth University indicates that the Japanese committees in fact persuaded the Americans to compensate the zaibatsu families with money instead of bonds, and this is what actually happened after 1952, as Some families were able to buy back their companies from the employees who bought those shares, and many subsidiary companies belonging to the zaibatsu managed to escape the control of the regime and regrouped after 1952. The system largely ended and large families no longer controlled the Japanese economy, and the emergence of The middle class came to the fore, although many families emerged from the crisis with the preservation or restoration of a large part of their property. With the industrial revolution in Japan and the economic miracle of the sixties, the need for another system came to protect the common interests of Japanese companies and reduce the risk of competition and control from foreign companies under the capitalist system, and here a new system emerged under the term “Keiretsu”.

The keiretsu system refers to an informal alliance between a group of Japanese companies that are bound together by common interests by buying small stakes in each other. The keiretsu system dominated the Japanese economy in the second half of the twentieth century. This system indicates that these companies will consider each other's interests because they have a stake in the other, and will make the task of a hostile takeover much more difficult for any foreign company, analyst Serkan Toto of consultancy Kantan Games explains in an interview with hitpoints and says that a forced takeover attempt would be suicidal, because all the partners would immediately sell their stakes (likely cheaply, causing the company's financial value to collapse), and the analyst even goes so far as to say:

Nothing is impossible at this time, but Microsoft's acquisition of a Japanese game publishing company would be more news than the Activision deal. So far, no Western company has succeeded in acquiring a Japanese game company, and I assure that there have been attempts, both from the West and from other countries in Asia.

In Japan, there are many keiretsu alliances, but the huge alliances that govern the entire Japanese economy and society are the eight major keiretsu alliances backed by banks, and these alliances include companies involved in all aspects of life from medicine and food through technology and entertainment to to construction and various industries. It should be noted that this system in the new millennium has become much weaker than it was before it, and the allied companies are no longer in the same level of centralization and integration. In any case, this system contributed to the protection of the group's companies, and when one of them needed money, she used to obtain it with loans and financial facilities from the bank responsible for supporting the keiretsu group. With regard to inward foreign investments, reports confirm that Japan ranks last among 196 countries in the world, and even comes behind North Korea in terms of the volume of inward foreign direct investments. This alone reflects the strength of Japanese companies in maintaining their identity. Over the years, and repelling attempts of acquisition and foreign investment.

Confirmation applies to video game companies as well. There have been mergers of Japanese video game companies in the past, but it was with local partners that Squaresoft and Enix merged, Sega and Sammy, Bandai and Namco, in addition to Koi and Tecmo. There are foreign companies that have investments in Japanese gaming companies including Tencent, but they have never reached full acquisition yet, not even a single small studio, let alone a large publishing company. The companies that belong to the same Cretsu work to take care of each other's interests, and do not enter into direct competition.

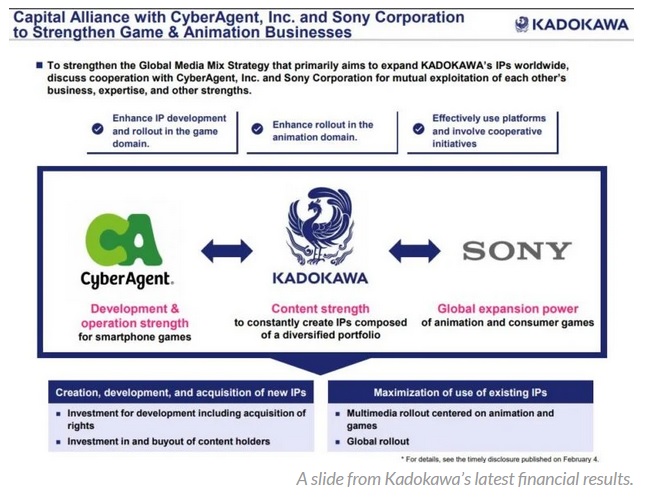

This idea of business alliances is very popular with Japanese companies, including Sony's investment in Kadokawa Games (which owns the development team From Software) that ensures it owns 1.9% of Kadokawa's value:

Also part of this alliance is CyberAgent, the company that owns CyGames. Kadokawa said that this deal will allow it to use Sony's global network to expand into the animation and video game sectors, and perhaps the Relayer game project is a product of this alliance. But if we look at this alliance in the light of commercial custom in Japan, this leads us to wonder whether the real goal of this partnership is to repel any external acquisition attempt on the hugely popular From Software development team, or even the acquisition of CYGames, which achieves giant successes on smartphones with games like Granblue Fantasy and ShadowVerse.

Nintendo also owns 5% of the shares of CYGames, and speaking of Nintendo, the company had previously made an alliance with DeNa, which specializes in smartphone games in the same image, as Nintendo acquired 10% of DeNa's shares, while DeNa acquired 1.5% of the shares Nintendo is the ninth largest investor in Nintendo's stock, and this deal resulted in smartphone projects such as Super Mario Run. Nintendo also owns an undisclosed stake in the GameFreak development team responsible for developing the Pokemon series of games and a stake in Creatures Inc, and the three companies together established the Pokemon Company to manage the Pokemon brand, in what appears to be an impenetrable alliance that repels any attempt to acquire this prestigious brand that Owned by the three of them without complete control of one of them over the rest.

We might also mention Sony's investment in Squaresoft when Final Fantasy The Spirits Within failed with an 18.6% stake in the company, making it the second largest investor in the company at the time, before Squaresoft merged with Enix to found Square Enix. Sony sold its stake in Square Enix later in 2014 to SMBC Nikko Securities, Inc, and while some saw that this was Sony's abandonment of a powerful partner and that the PlayStation might no longer need Square Enix, the truth was quite the opposite. Sony was facing many financial challenges at the time, and Square Enix saw the sale as a kind of repaying favor and helping Sony. This is what Shinji Hashimoto confirmed at Comic-Con Thailand:

There was a discussion between the heads of the two companies and the result is known, there was no controversy or disagreement. Since Sony helped us in the past, it's time for us to help Sony.

Japanese companies care about each other in a relatively different way than is common in other parts of the world, and in fact, there are a very large number of Japanese companies founded hundreds of years ago. Nintendo was founded in 1889. Companies that are linked to each other in a vertical relationship within the supply chain are trying to invest in each other and take into account their interests, and thus their relationship is somewhat different from the fierce competition between them in the Western world, which is simply the relationship of the seller to the buyer.

In any case, the market is changing, the environment is changing, and relationships are changing, and the question remains whether companies such as the American Microsoft and the Chinese Tencent will be able to acquire Japanese game companies, or will the latter succeed in maintaining their independence in light of the massive merger movements that began to dominate the industry. Video games. There is also the possibility that a company such as Microsoft will acquire a percentage of the share of a Japanese publisher and make an alliance without fully acquiring the company, and there are many examples of similar cases for Japanese companies such as Ford acquiring a large share of Mazda shares, but when Ford decided to sell 20% of its shares in Mazda, Mazda bought 6.9% of its shares, and 20 Mazda partners, whose identities were not disclosed, bought the remaining 13%, and although the relationship remained strong between the two parties, Mazda partially regained control and independence after that.

The market is constantly changing, the coming years will be very exciting for the video game industry after many huge companies around the world have realized the utmost and extreme importance of providing content, and the question remains whether the next shape of the market will accommodate the presence of medium-sized companies such as Japanese game publishing companies, or whether the fish The big ones… will keep swallowing the small fish.

No comments